Polypropylene: New production capacity in September was 1.5 million tons

Polypropylene (PP): New production capacity in September was 1.5 million tons, wire drawing and injection molding production increased, and supply pressure increased in South China

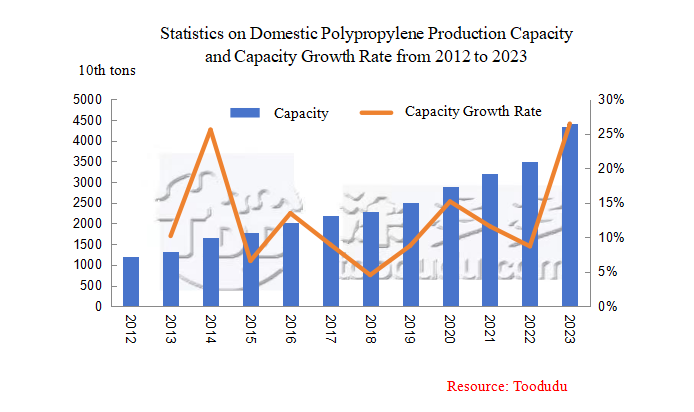

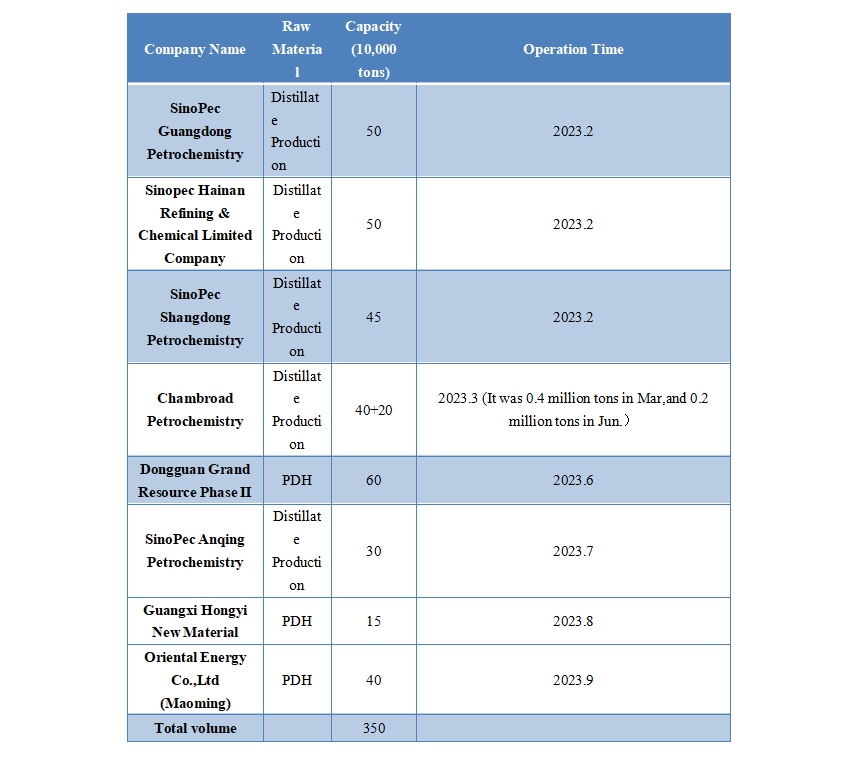

In 2023, domestic polypropylene production will experience a massive expansion, with a total planned expansion of 8.2 million tons at the beginning of the year. By then, the domestic polypropylene production capacity will reach 43.16 million tons, with a capacity growth rate of 23.46%. According to Toodudu's statistics, as of now, a total of 3.5 million tons of newly added polypropylene production capacity would been invested in China, with a production progress of 42.68%. In September, the Oriental Energy (Maoming) (400000 tons/year) completed production in early September and is currently producing normal wire drawing material T03. Ningxia Baofeng Energy (500000 tons/year) Phase III is expected to produce products in the near future, and PowerChina Gansu Energy Huating Power Generation (200000 tons/year) and Ningbo Kingfa (400000 tons/year) have also entered the testing phase, and they are expected to be put into production by the end of September. Specifically, in terms of products, the production of Oriental Energy (Maoming) and Baofeng Energy Phase III new devices will mainly focus on homopolymer products, with a possible slight increase in the supply of wire drawing and homopolymer injection molding.

Chart 1

Table 1

With the increase of production capacity, domestic polypropylene production has also followed. From January to August 2023, the domestic polypropylene production was 20.7889 million tons, an increase of 1.5062 million tons or 7.81% compared to the same period last year, which was 19.2827 million tons. Among them, the domestic polypropylene production reached 2.81 million tons in August, setting a new high in history.

In September, the overall domestic supply remained at a high level, with a conservative estimate of domestic polypropylene production of over 2.8 million tons. On the one hand, there has been a decrease in the maintenance of in-process equipment, with a total of 2.58 million tons of equipment repaired in September. However, except for SinoPec Sichuan Petrochemistry (450000 tons/year) and SinoPec Shanghai Petrochemistry (200000 tons/year for the first and second lines), other enterprises are mainly participate in some minor repairs in about a week; On the other hand, with the implementation of new production capacity, market supply has gradually increased from mid to late. However, the supply situation between regions varies. Among them, the production in North China has decreased, mainly due to the maintenance of Chambroad Petrochemistry, Tianjin Chambroad Petrochemistry, and SinoPec Shangdong Petrochemistry (which closed on September 5th and opened on September 12th). It is expected that the production in North China will significantly decrease in September; The production of Kingfa Technology's new device in East China has been delayed until late, while the maintenance of devices such as SinoPec Zhejiang Petrochemistry, Oriental Energy Co.,Ltd, and SinoPec Shanghai Petrochemistry, has resulted in a decrease in overall supply within the month; With the landing and production of new devices such as Guangxi Hongyi New Material and Oriental Energy Co.,Ltd (Maoming) in the southern region, the overall supply continues to increase.

Chart 2

From the perspective of the implementation of production capacity in the late stage, there are still certain variables, mainly due to the periodic loss of profits caused by upstream cost pressure for manufacture enterprises. Against the backdrop of strong oil prices, since July, the price of propane in the external market has risen sharply, supported by multiple positive factors such as the impact of weather on import port arrivals and an increase in refinery maintenance. Taking Oriental Energy's propane price as an example, at the beginning of July, the propane price was 3950 yuan/ton, and the current price has risen to 5350 yuan/ton. In two and a half months, the price has increased by 1400 yuan/ton, an increase of up to 35.44%. Although the domestic price of polypropylene has also been rising, it is far behind the rate of increase in raw material. At present, the production of polypropylene produced by PDH is experiencing severe losses, leading to a certain possibility of delay in the deployment of some new production capacity. However, from the perspective of the whole year, increase in supply in the domestic polypropylene market will show an inevitable trend.